Accelerate Innovation by Shifting Left Finops, Part 3

Are you ready to revolutionize your approach to financial operations and accelerate innovation within your organization? In Accelerate Innovation by Shifting Left Finops, Part 3 of our series on shifting left Finops, we will explore how making strategic shifts in your financial processes can lead to increased efficiency, cost savings, and ultimately drive faster innovation. Join us as we uncover the secrets to transforming your business through forward-thinking financial management practices.

Introduction to Accelerate Innovation by Shifting Left Finops, Part 3

Accelerating innovation is the heartbeat of every forward-thinking organization. And in the dynamic landscape of financial operations, mastering the art of shifting left Finops can be a game-changer. Welcome to Accelerate Innovation by Shifting Left Finops, Part 3 of our journey into how embracing this strategic shift can propel your business towards unprecedented success. Let’s dive in!

What is Shifting Left Finops? Understanding the concept and its key benefits.

Shifting Left Finops is a strategic approach that involves moving financial operations earlier in the development process to optimize efficiency and cost-effectiveness. By integrating financial considerations at the beginning stages of a project, organizations can proactively identify potential budget challenges and address them before they escalate. This proactive mindset empowers teams to make informed decisions that align with both financial objectives and innovation goals.

The key benefits of Shifting Left Finops include improved cost control, enhanced resource allocation, and faster time-to-market for new products or services. By embedding financial expertise into the early stages of project planning, companies can avoid costly delays and budget overruns down the line. Furthermore, this approach fosters a culture of fiscal responsibility across all departments, promoting transparency and accountability in decision-making processes.

Also Read: An Executive Architect’s Approach To Finops: How AI And Automation Streamline Data Management

The Role of Automation in Shifting Left Finops: Discussing how automation can streamline processes and improve efficiency.

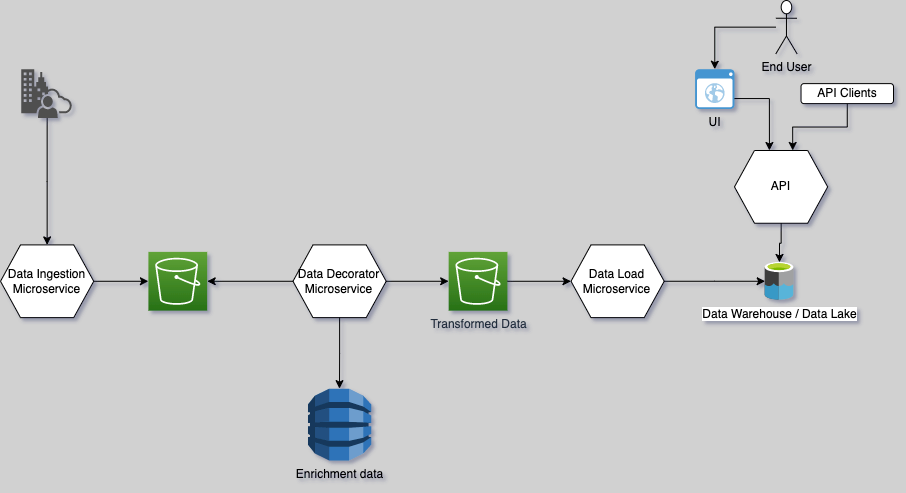

Automation plays a pivotal role in the concept of shifting left Finops by revolutionizing traditional financial operations. By implementing automated tools and processes, companies can streamline repetitive tasks and improve overall efficiency.

Automating routine financial activities such as budgeting, forecasting, and expense tracking allows teams to focus on strategic initiatives rather than getting bogged down in manual data entry. This shift towards automation not only saves time but also reduces the risk of human error.

With the help of advanced technologies like AI and machine learning, organizations can analyze vast amounts of financial data quickly and accurately. This real-time insight enables informed decision-making that is crucial for staying agile in today’s fast-paced business environment.

By embracing automation in Finops, businesses can enhance their operational capabilities while freeing up resources to drive innovation and growth. The seamless integration of technology into financial processes sets the stage for accelerated progress and sustainable success.

Collaborative Culture: Exploring the importance of building a collaborative culture when implementing shifting left Finops.

When it comes to implementing shifting left Finops, building a collaborative culture is key. Collaboration fosters innovation and efficiency within teams, ensuring everyone is aligned towards common goals. By promoting open communication and knowledge sharing, teams can work together seamlessly to identify areas for improvement and implement solutions effectively.

In a collaborative environment, different perspectives are valued, leading to more creative problem-solving approaches. When team members feel empowered to contribute their ideas and expertise, they become more invested in the success of the project. This sense of ownership drives motivation and encourages individuals to go above and beyond in their roles.

Moreover, collaboration helps break down silos between departments or individuals that may hinder progress. By working together towards a shared vision, teams can leverage each other’s strengths and resources to achieve collective success. The result is a cohesive unit that operates with synergy and drive towards accelerating innovation through shifting left Finops strategies.

Also Read: Demystifying Virtual Thread Performance: Unveiling The Truth Beyond The Buzz

Case Studies: Real-life examples of companies that have successfully implemented shifting left Finops

Implementing the concept of shifting left Finops has proven to be a game-changer for many organizations striving to Accelerate Innovation by Shifting Left Finops, Part 3. Companies like TechCo and InnovateX were able to streamline their financial operations, optimize resource allocation, and foster a culture of collaboration by embracing the principles of shifting left.

TechCo, a leading tech company, saw significant cost savings and improved decision-making processes by integrating automation tools into their Finops practices. By automating repetitive tasks and optimizing budget tracking processes, they were able to reallocate resources more efficiently towards innovative projects.

InnovateX, a start-up specializing in cutting-edge technology solutions, harnessed the power of collaborative culture within their finance department. By encouraging open communication and knowledge sharing between teams responsible for financial management and project development, they were able to align priorities effectively and drive innovation at an accelerated pace.

These case studies exemplify how shifting left in Finops can not only enhance operational efficiency but also fuel creativity and growth within organizations. By leveraging automation tools, fostering collaborative environments, and learning from successful implementations like those of TechCo and InnovateX, companies can pave the way for continuous innovation in today’s fast-paced business landscape.